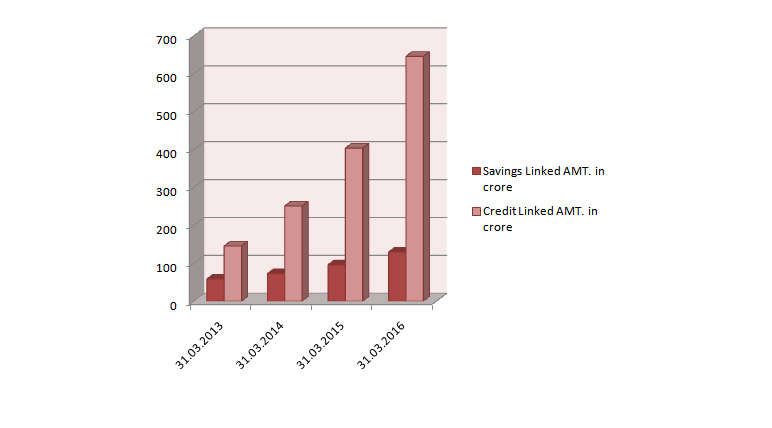

Since inception, Paschim Banga Gramin Bank has given thrust on rural credit / microfinance. At present we are having 52916 nos. savings linked SHGs, out of which 39731 nos. are credit linked. From the above position it is crystal clear that a large number of SHG cases are likely to be credit linked in this financial year 2016-17.

Farmers’ Clubs are grass root level associations and have strong links with the local community having influencing powers. As they emerge from the community itself they also have the knowledge of the local milieu. It is an important link between bank and local community.

At present our bank is suffering from acute manpower shortage and for that reason some times branches are not in a position to scout any loan proposal and even credit linking the matured SHGs. Since our bank has given thrust on rural credit through financing SHGs, JLGs and KCC, we use to take the help of these Farmers’ Club for disbursement and recovery. It is proven fact that in order to accelerate credit flow and good recovery there against, micro finance through Self Help Group is the effective tool of the Bank. For this reason, we have engaged Farmers’ Clubs as Business Facilitator(BF) and give commission at least 0.5% on loan amount of SHGs.

In this backdrop, we have decided that all eligible savings linked A/Cs should be credit linked and Minimum amount should be Rs.1.50 lac per SHG. We have at least 2000 SHGs who have taken loan above Rs. 5 lac. These Group members are all women and most of the women are involved in the Allied Agril activities, “KANTHA STITCH SARI” making and other business activities also.

We also observed that we are having near about 25000 credit linked Groups, whose age more than 3 years. Therefore, we can finance 25000 groups at least Rs.3 lac per Group. Last year our total outstanding advance was Rs.1984crore, out of which SHG advance was Rs. 645.48crore (33% of gross advance). This year our estimated target to our SHG outstanding advance is Rs. 950crore.

Bank has decided to open individual S.B A/C of all the group members. After this decision, number of S.B. A/Cs and CASA deposit have been remarkably increased. Our NPA against SHG finance is below Rs. 5crore(0.77%). As on today our total Branches are 230 spreading over 4 District namely Howrah, Hooghly, Bardhaman and Birbhum.

We are constantly monitoring the groups and holding regular meetings with the members with missionary zeal for empowerment of rural women and uplifting the standard of living as well as the education of their children. We are going to undertake a programme of plantation of trees in our villages with the help of SHGs to render service to the nature as well as to the nation.

| SHG POSITION | Amt. in Crore | |||

| As on | Savings Linked | Credit Linked | ||

| Year | A/C | AMT. in crore | A/C | AMT. in crore |

| 31.03.2013 | 37878 | 58.43 | 25238 | 145.46 |

| 31.03.2014 | 39872 | 72.56 | 31225 | 250.93 |

| 31.03.2015 | 44447 | 95.81 | 34220 | 403.59 |

| 31.03.2016 | 52916 | 129.75 | 39731 | 645.48 |